Chemistry

Powering the bottom line

A risk-based optimization scheme boosts confidence and profitability for future mixed-technology power plants.

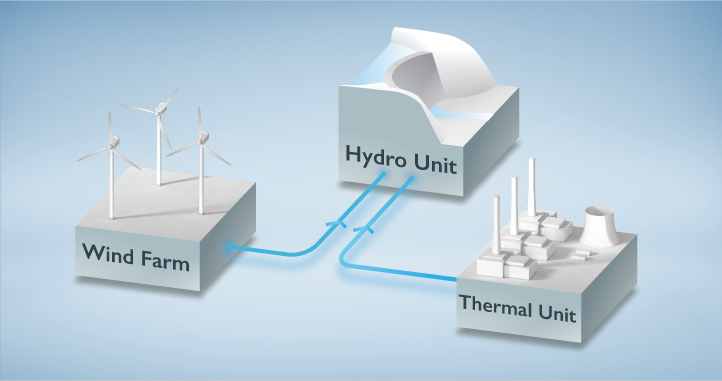

A scheme to balance risks may help realize the benefits of being able to combine complementary power technologies, such as thermal generation, wind power and energy storage. Such benefits include lower capital costs and more responsive and reliable energy delivery while leveraging renewable energy technologies

Optimizing the operation of a mixed-technology power plant is vital to make such power generation profitable and reliable. However, this is far more complex than for single-technology units due to the simultaneous fluctuations in generation caused by inconsistent wind, for example, as well as fluctuations in energy storage levels and market electricity prices.

While optimization schemes have been proposed for such virtual power plants (VPPs), the existing approaches take a rigidly risk-neutral approach to dealing with uncertainty in future conditions.

Now, by integrating risk parameters into an efficient optimization program for VPP operation, Ricardo Lima and colleagues Omar Knio and Ibrahim Hoteit from KAUST have developed a platform that allows the system to be tweaked for better reliability and profitability. “Renewable energy resources are inherently uncertain,” explains Lima. “The operation and interaction of these resources with the electricity market brings uncertainty about how to best maximize profit.” Furthermore, “this methodology enables us to capitalize on wind ensembles from weather forecast models, accounting for the uncertainties inherent in future projections,” says Hoteit

The problem considered by Knio’s team is the optimization of operations and electricity market participation for a VPP comprising a thermal unit, such as a conventional gas-fired power plant, a wind farm and a pumped storage hydro unit for energy storage. The goal of the calculation is to predict the optimal energy output of the thermal unit and input/output from the hydro unit, with consideration for fluctuating wind conditions and electricity price in the market, which will optimize profit over the next few hours.

“The key issue for optimization is always the balance between level of detail of the model and the capacity for obtaining optimal solutions from it,” says Lima. “In this work, we propose efficient approaches to solve large problems and push the limits of the problem sizes we can solve in reasonable computational times.”

This is a large-scale calculation problem with many variables even before the inclusion of risk, which presents significant challenges for finding the most accurate solution. To be able to consider the additional complexity of risk, the team has to develop an efficient calculation scheme, which they achieved by calculating the two parts in parallel. The result is a framework that can accommodate both conservative risk-avoidance and aggressive risk-seeking approaches to maximize VPP profits.

“Our optimization model supports the calculation of risk-averse decisions that hedge against low profits due to the uncertainty in future wind-power generation and electricity prices,” says Lima.

References

-

Lima, R. M., Conejo, A.J., Langodan, S., Hoteit, I. & Knio, O.M. Risk-averse formulations and methods for a virtual power plant. Computers and Operations Research 96, 350-373 (2017).| article

You might also like

Chemistry

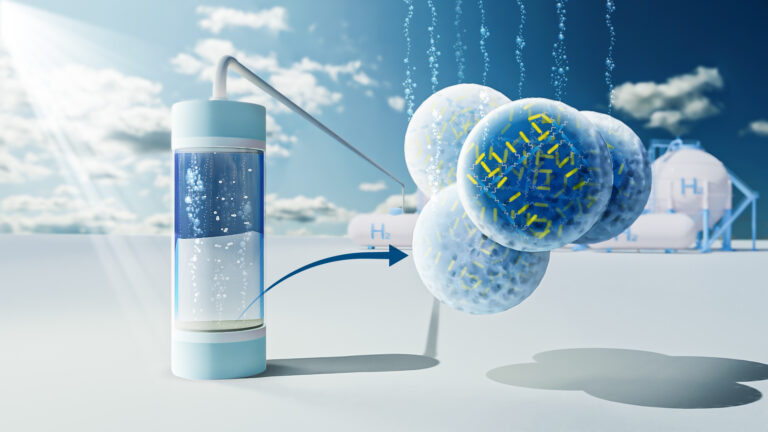

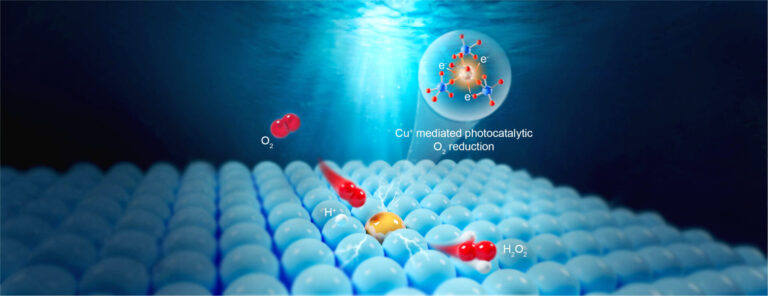

Turning infrared solar photons into hydrogen fuel

Applied Physics

Natural polymer boosts solar cells

Chemistry

Disruptive smart materials flex with real world potential

Chemistry

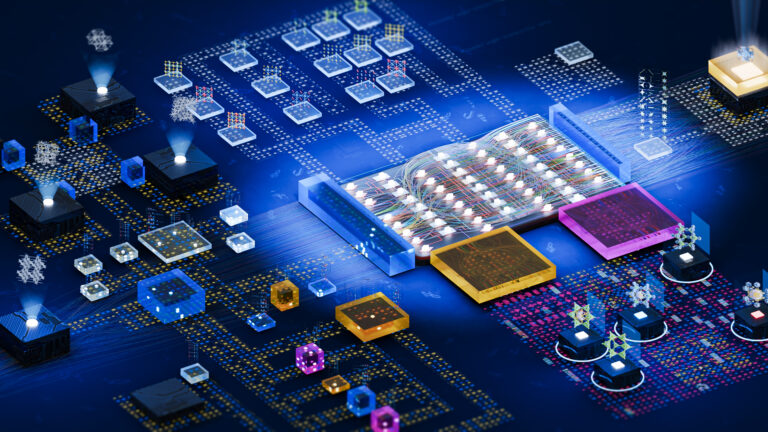

Catalysts provide the right pathway to green energy

Chemistry

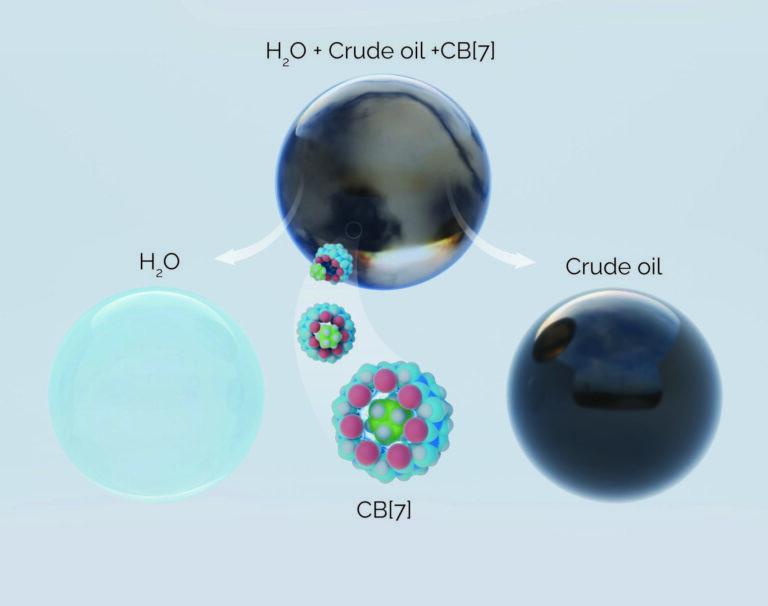

Hollow molecules offer sustainable hydrocarbon separation

Chemistry

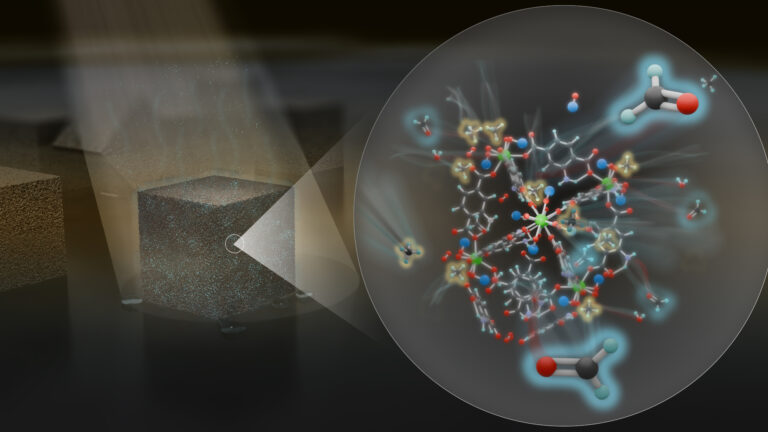

Maximizing methane

Chemistry

Beating the dark current for safer X-ray imaging

Chemical Engineering